At a Glance

- Company: Lendero LLC

- Industry: Financial services / alternative funding

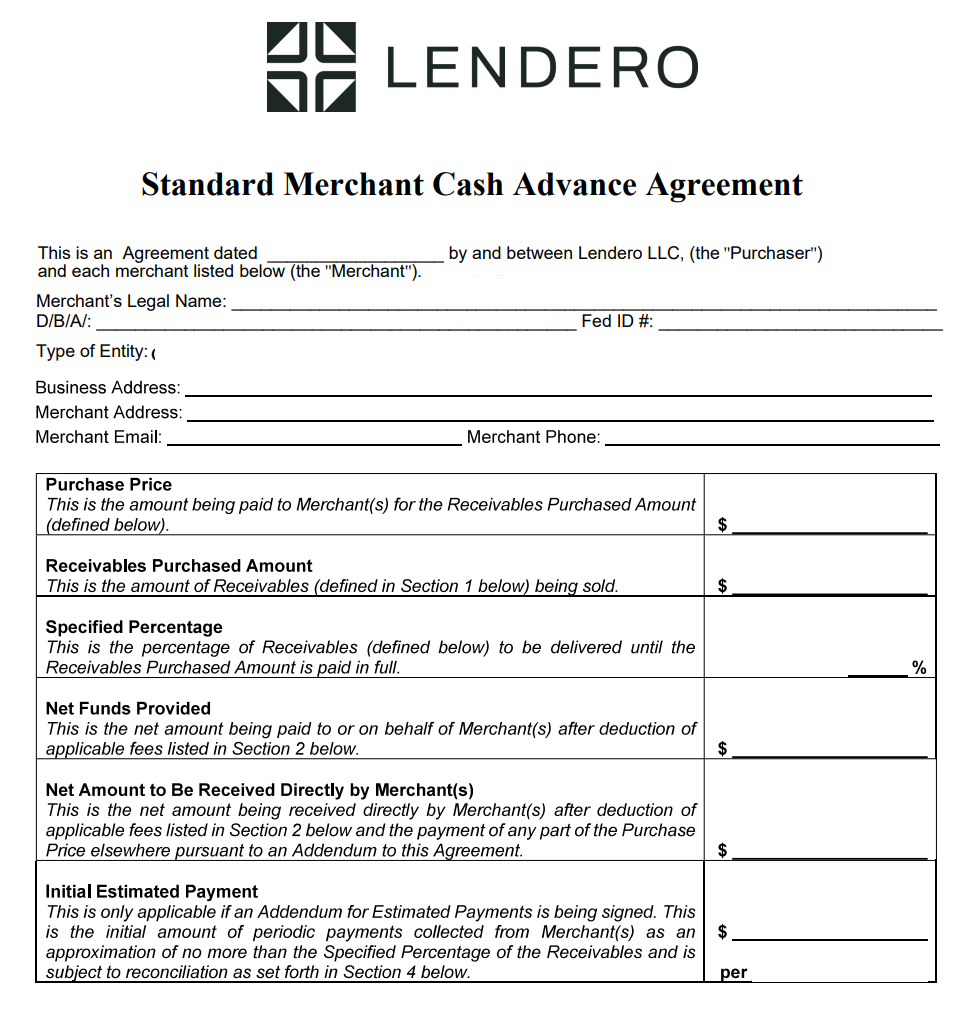

- Use Case: Automating preparation of multi-page Merchant Cash Advance (MCA) agreements from form data

- Forms: Lendero Master Standard MCA Agreement (corporate MCA agreement)

- Primary Needs: Seamless integration between online intake form and fillable PDF; precise mapping of repeated merchant fields; AI control for logic-driven field behaviour

- Integration: Cognito Forms

About the Company

Lendero LLC is a US-based finance provider specializing in merchant cash advances, a funding model where businesses sell future receivables in exchange for immediate capital. The company needed to optimize its workflow around Merchant Cash Advance (MCA) agreements – complex, compliance-bound documents requiring meticulous data entry from sale applications.

Executive Summary

The merchant cash advance industry provides working capital to small businesses by purchasing future receivables at a discount. Unlike traditional loans, MCAs offer fast funding – often within 24-48 hours – making them attractive to businesses that need immediate liquidity.

Speed is the competitive advantage. Companies that can process applications quickly and generate funding agreements faster win deals. But that speed advantage gets bottlenecked by manual document preparation: extracting application data and transferring it field-by-field into multi-page legal agreements. For a funding company processing dozens of deals monthly, this administrative burden directly limits deal flow capacity.

The Challenge: Manual Contract Generation

Lendero LLC collected merchant applications through Cognito Forms – a form builder that offers workflow automation features. Sales representatives would submit completed applications through the web form, which captured:

- Merchant business information (legal name, DBA, Federal ID)

- Entity type (Corporation, LLC, Partnership, Sole Proprietor)

- Contact addresses and authorized signers

- Requested advance amount

- Purchase price (repayment amount)

- Banking details and business financial data

Once submitted, someone had to manually transfer this data into the Standard Merchant Cash Advance Agreement – a multi-page legal contract with dozens of fillable fields across the main agreement and addendum pages.

Document Complexity

The agreement requires precise data entry across multiple sections:

- Cover page: Agreement date, merchant legal name, DBA, Federal ID, entity type selection, contact address

- Financial terms: Requested advance amount, purchase price/repayment amount, specified percentage of receivables

- Addendum pages: Support for multiple merchant entities with repeated field sets (legal name, DBA, Fed ID, entity type, contact address, signature blocks)

Each field must be filled accurately. Errors in legal names, Federal IDs, or financial amounts could invalidate agreements or create compliance issues.

The Integration Challenge

While Cognito Forms captured data, there was no efficient path from form submission to completed contract. The options were:

- Manual copy-paste: Time-consuming, error-prone, doesn’t scale

- Custom development: Expensive, requires ongoing maintenance

- Form automation tool: Required one that could handle complex legal documents and integrate with Cognito Forms via webhook

The team discovered Instafill.ai through a Google search and signed up to implement automated document generation.

The Solution: Webhook-Driven Automation

Step 1: Form Conversion

The Standard Merchant Cash Advance Agreement was originally a flat PDF – a static document without fillable form fields. Before automation could begin, the document needed conversion to a fillable PDF format.

Instafill.ai’s team converted the flat document into a fillable PDF form. The conversion was completed within 24 hours of signup and uploaded directly to Lendero’s Instafill.ai account.

Step 2: AI Fine-Tuning

Once the fillable form was ready, Instafill.ai performed AI fine-tuning – a process that analyzes the form’s structure to achieve 99–100% field-level accuracy. This teaches the AI how to handle specific form logic, constraints, and table layouts, making all subsequent fills for that form instantaneous.

This process revealed an important issue: the agreement includes complex checkbox logic for entity type selection. When “Corporation” is selected, all other entity type checkboxes (LLC, Partnership, etc.) must remain unchecked. The AI fine-tuning correctly mapped this logic, ensuring mutually exclusive checkbox behavior.

Fine-tuning took approximately 3-5 minutes and only needed to be done once. After that, the form was ready for use.

Step 3: Cognito Forms Webhook Integration

The breakthrough came from connecting Cognito Forms directly to Instafill.ai via webhook automation.

Here’s how it works:

- Configure webhook in Cognito Forms:

Navigate to form Settings → Submissions → Webhooks

Add webhook URL:https://instafill.ai/api/autofill/webhook/{formId}?apiKey={apiKey} - Generate API key in Instafill.ai:

Go to Organization Settings → API Keys

Generate a new key specifically for the webhook integration - Find Form ID:

Open the target form in Instafill.ai Forms and copy the form ID from the URL bar

With the webhook configured, every Cognito Forms submission triggers immediate form filling. No manual intervention required.

Step 4: Testing and Accuracy Refinement

Initial webhook testing revealed a critical accuracy issue: one of the fields was consistently populated with incorrect values. The problem traced back to field description confusion. The form contained two similar financial fields:

- Requested Advance Amount USD: The amount the merchant is requesting

- Purchase Price Repayment Amount USD: The total amount to be repaid (advance + fees)

The AI was incorrectly mapping the Purchase Price to the Receivables Purchased Amount field. The issue was identified through manual review of filled sessions in the Instafill.ai dashboard.

The fix: The team updated the field description in the form’s field editor, clarifying which source data field should map to which form field. After this adjustment, accuracy reached 100% across all test submissions.

Step 5: Technical Issue Resolution

During implementation, the team encountered a rare but critical bug: webhook-triggered filling was occasionally failing with a cryptic error.

The root cause was traced to a prompt generation issue when handling certain field groups (specifically, list item groups where the AI needed to map multiple data points to a repeating structure). The AI prompt was returning an error object that the processing code couldn’t parse correctly, causing the entire fill operation to crash.

The fix involved two adjustments:

- Updated the prompt to return empty JSON instead of an error object when no data mapping is possible

- Added error handling to catch and log unexpected prompt responses

The Result: End-to-End Automation in Under 2 Minutes

With the webhook integration complete, the funding workflow transformed:

Before Instafill.ai:

- Sales rep completes Cognito Form

- Submission notification sent via email

- Operations team downloads submission data

- Manual data entry into agreement template (15-20 minutes)

- Review for accuracy

- Send to merchant for signature

After Instafill.ai:

- Sales rep completes Cognito Form

- Webhook triggers automated form-filling (under 2 minutes)

- Completed agreement delivered via email

- Quick review for accuracy

- Send to merchant for signature

Measurable Outcomes

| Metric | Before Automation | After Automation |

|---|---|---|

| Processing Time | 15–20 minutes per contract | < 2 minutes per contract |

| Accuracy | Prone to transcription errors | 99–100% after fine-tuning |

| Manual Intervention | Required for every submission | Eliminated for standard deals |

| Scalability | Constrained by staff capacity | Scales automatically with volume |

Email Delivery

Every completed agreement is automatically delivered via email with the filled PDF attached. The operations team can also access all filling sessions at any time through the Instafill.ai dashboard, where they can review the filled form and download it as a flat or fillable PDF.

Why Webhook Automation Matters for Financial Services

Merchant cash advance companies, alternative lenders, and commercial financing firms operate in a time-sensitive market. Businesses applying for working capital need answers quickly—and they’ll choose the funder who can move fastest.

Manual document preparation creates two major problems:

- Speed bottleneck: Operations staff become the constraint on deal flow

- Error risk: Manual data entry introduces transcription mistakes that can delay funding or create compliance issues

Webhook automation solves both problems by:

- Eliminating the manual data transfer step entirely

- Processing applications instantly upon submission

- Maintaining consistent accuracy through AI field mapping

- Scaling efficiently without requiring additional headcount

Integrating Instafill.ai with an online form platform like Cognito Forms removes repetitive work and reduces the risk of errors. By learning from this and other automation stories, teams in similar industries can appreciate how automating lengthy contracts leads to faster turnaround, fewer mistakes, and a better client experience.